do nonprofits pay taxes on utilities

Yes nonprofits must pay federal and state payroll taxes. However this corporate status does not.

Utility Assistance From Nonprofits Nc211

They must pay payroll tax all sales and use tax and unrelated business income.

. But nonprofits still have to pay. Most nonprofits fall into this category and enjoy numerous tax benefits. The rules can be complicated and there may be exceptions or exemptions that apply to your specific situation.

In most cases they wont owe income taxes at the state level either as long as they present their IRS letter of determination to the states Department of Revenue. Nonprofit organizations that receive an exemption identification number E number from the Department are exempt from state sales and use tax when purchasing. Do nonprofit organizations have to pay taxes.

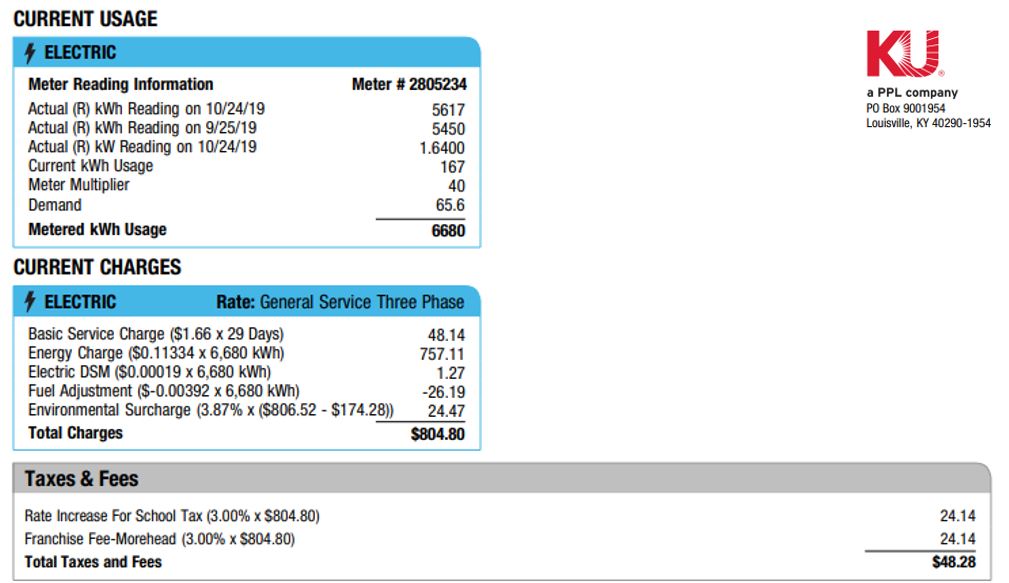

Employees collecting a payroll check from a nonprofit or church are just as liable as the rest of us making a living. Taxes on money received. Effective February 2019 non-profit organizations and government agencies seeking a utility sales tax exemption should complete Form ST-109NPG and provide it directly to the utility.

Nonprofit organizations must apply for exemption with the Comptrollers office and receive exempt status before making tax-free purchases. Nonprofits and churches arent completely off of Uncle Sams hook. Federal and Texas government entities are automatically exempt from applicable taxes.

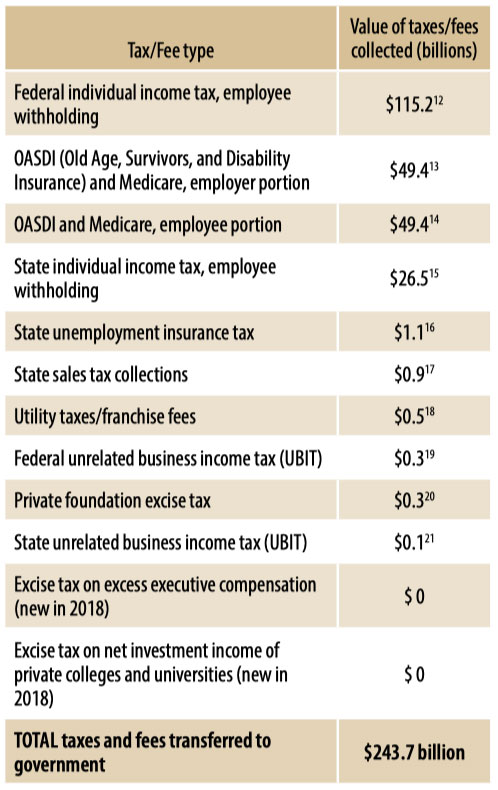

Taxes Nonprofits DO Pay. We recognize that understanding tax issues related to your organization can be time-consuming and complicated. UBI can be a difficult tax area to navigate for non-profits.

Below is a beginners guide intended for high-level determination of whether rental income is subject to unrelated. Your recognition as a 501 c 3 organization exempts you from federal income tax. But they do have to pay.

Utilities sold for residential purposes are exempt from the 4 New York state sales tax. The research to determine whether or not sales. Effective Sunday churches will no longer have to pay sales tax on utilities including electricity water and natural gas.

2 Tax Issues Relating To Charitable Contributions And Organizations Everycrsreport Com Do Nonprofits Or. According to the Michigan tax code at the time of publication churches schools charities eligible hospitals. First and foremost they arent required to pay federal income taxes.

Certain nonprofit and government organizations are eligible for exemption from paying Texas taxes on their purchases. 501c3s do not have to pay federal and state income tax. Do Nonprofits Pay Taxes.

However here are some factors to consider when. State sales tax exemption on utility bills Revenue Administrative ulletin 1995-3. Whether or not nonprofits have to pay sales tax on taxable purchases depends on the state and local tax rules that apply to that transaction.

Employment taxes on wages paid to employees and. Do nonprofits pay taxes on utilities Wednesday June 1 2022 Edit. And it doesnt stop there.

As long as 75 of the energy being purchased is used for residential purposes all of. Organizations granted nonprofit status by the Internal Revenue Service IRS are generally exempt from tax they must pay some types. The IRS which regulates tax-exempt status allows a 501 c 3 nonprofit to pay reasonable salaries to officers employees or agents for services rendered to further the.

Not only will the employee pay their share of taxes. Non-profit status may make an organization eligible for certain benefits such as state sales property and income tax exemptions. For assistance please contact any of the following Hodgson.

Most nonprofits do not have to pay federal or state income taxes. House Bill 582 which legislates the tax exemption. We want to help you get the information.

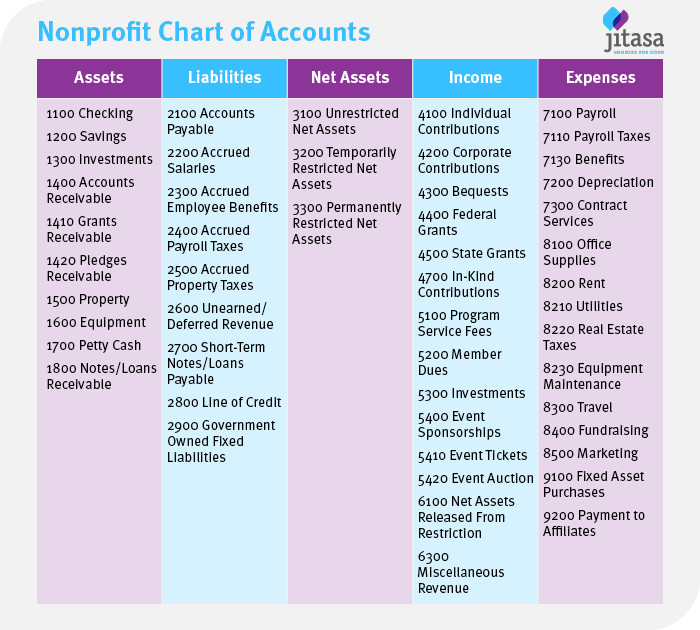

Establishing A Nonprofit Chart Of Accounts Jitasa Group

Rural Electric Co Ops See Benefits In Inflation Reduction Act

A Non Profit S Guide To Solar Energy

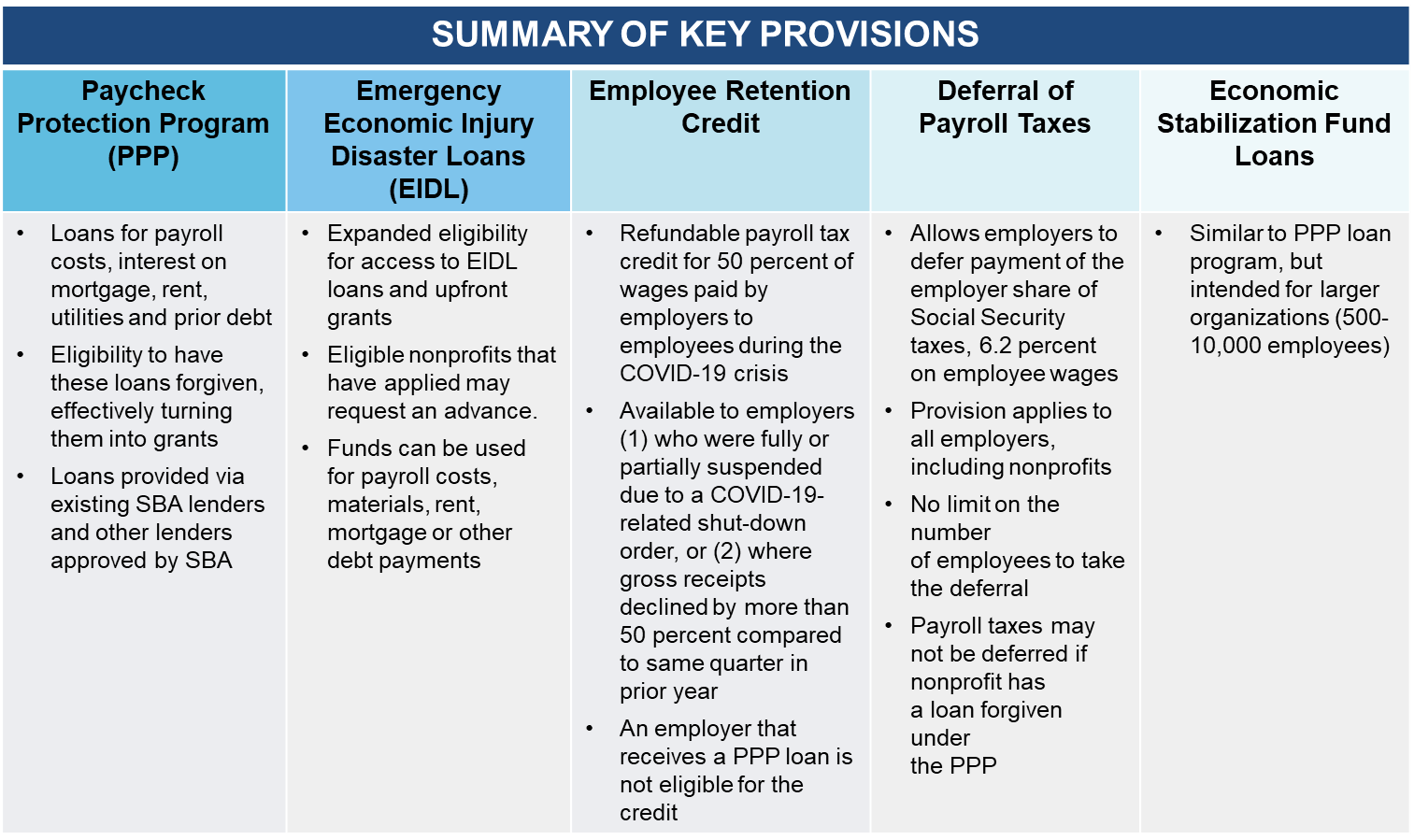

The Cares Act And Beyond A Covid 19 Government Assistance Guide For Nonprofits Fiducient

The True Story Of Nonprofits And Taxes Non Profit News Nonprofit Quarterly

How To Find Rent And Utility Assistance In Houston 2020

The Cares Act And Nonprofit Organizations Butler Snow

Funding Sources For Businesses Nonprofit Organizations And Individuals Clayton County Development Group

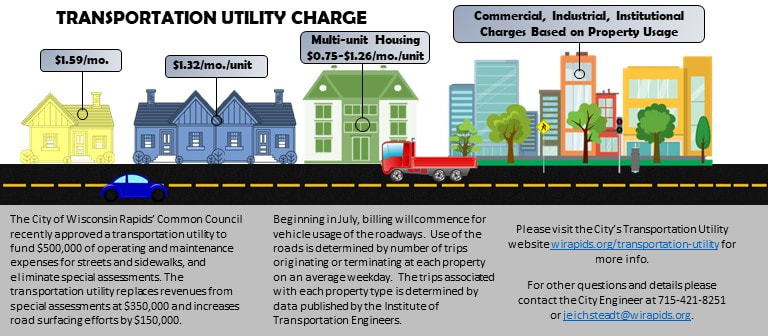

Transportation Utility City Of Wisconsin Rapids

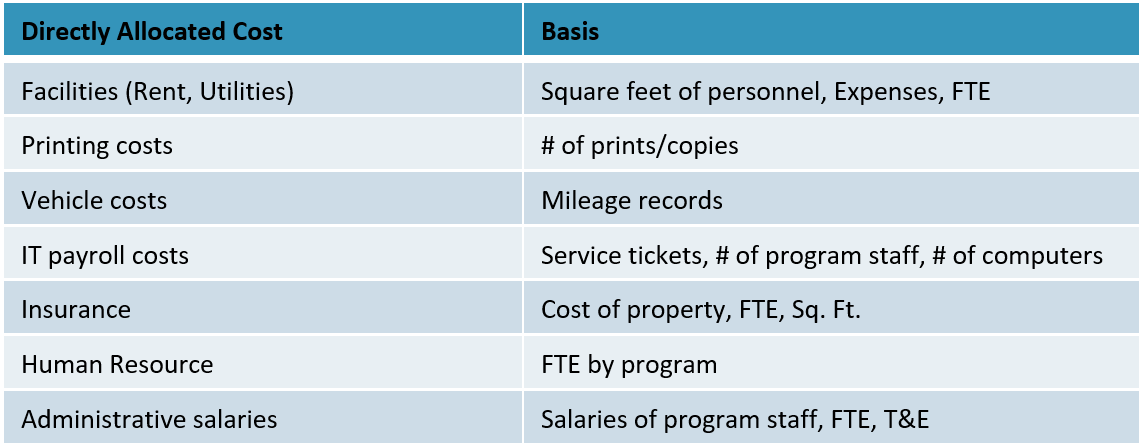

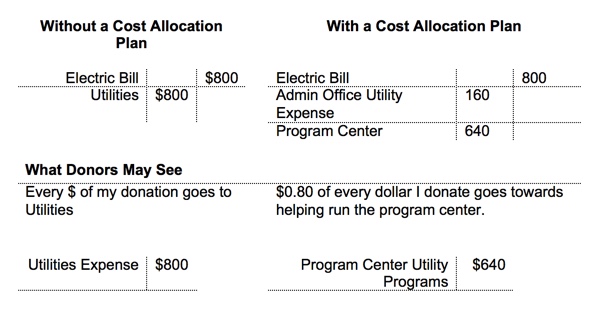

Why A Cost Allocation Plan Is Important For Nonprofits Ernst Wintter Associates Llp

2020 Guidelines For A Nonprofit Reimbursement Policy

Balancing Nonprofit Administrative Costs With Growth Netsuite

What Is A Nonprofit Definition And Types Of Nonprofits Starting Up 2022

Non Profits Being Charged Sales Tax Mountain Association

How Do Non Profit Business Owners Get Paid The Blue Heart Foundation

Low Income Assistance And Nonprofits